Sienna MUD Districts Have Rescinded All Drought Contingency Response Measures

Posted: October 9, 2023 at 9:28 AM

Due to the recent rain and cooler weather, Sienna MUDs have rescinded all Drought Contingency Response Measures.

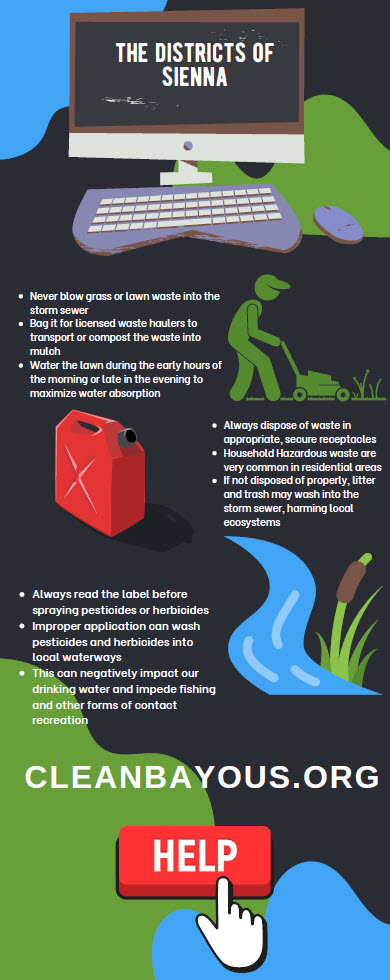

Residents can still help reduce water demand by following the following conservation tips:

- Routinely monitor irrigation systems for leaks.

- Irrigate lawns in early morning and late in the evenings.

- Check indoor plumbing for leaks and running toilets.

All Sienna MUD Districts are Currently Operating Under Stage 2 Drought Response Measures

Due to the ongoing drought conditions, all Sienna MUDs have initiated Stage 2 of their Drought Contingency Plans.

Mandatory Water Conservation Measures are now in place.

All outdoor water usage not limited to Lawn and Garden Watering, Car Washing, and Window Washing, shall be limited as follows:

- Outdoor water use shall be prohibited between the hours of 6:00 a.m.-10 a.m. and between the hours of 6:00 p.m. and 12:00 a.m. (midnight)

- Only district residents with even-numbered addresses may water on even numbered days.

- Only district residents with odd-numbered addresses may water on odd numbered days.

Stage 1 Drought Response Measures

All Sienna MUD Districts are currently operating under Stage 1 Drought Response Measures

Due to the ongoing drought conditions, all Sienna MUDs have initiated Stage 1 of their Drought Contingency Plans.

Voluntary water conservation measures are now in place.

The district is asking all residents and businesses’ to voluntarily reduce their water usage.

Residents can help reduce water demand by following the following conservation tips:

- Routinely monitor irrigation systems for leaks.

- Irrigate lawns in early morning and late in the evenings.

- Check indoor plumbing for leaks and running toilets.

Thanksgiving Day Trash Collection

In observance of Thanksgiving, there will be no service on Thursday, November 25th. Trash collection will resume on the next scheduled service day.

Tax Transparency

Information about the District required by Section 26.18, Texas Tax Code, created by Senate Bill 2 (also known as the Texas Property Tax Reform and Transparency Act of 2019), is available below: